GST Tax Notice

A GST Notice is a message from the GST Department to a taxpayer. It could be a reminder, a warning about an error in GST filing, or a request for more details. It’s very important to respond to these notices on time. If ignored, it can lead to penalties or even legal action.

That’s why handling GST notices carefully is a must.

At Filingwise our GST experts make this process easier for you. Whether you’ve already received a notice or think you might get one, we’ll help you prepare the right response and submit it without stress.

Get in touch with us today for expert support and a quick reply.

Types of GST Notices (Explained Simply)

Under GST, taxpayers may receive different types of notices from the authorities. Here are the most common ones:

Show Cause Notice (SCN): Sent when the department suspects a GST violation. You’ll need to explain or justify your case.

Demand Notice: Issued when the department finds you owe tax, along with interest or penalties.

Scrutiny Notice: Sent if your GST returns or records are being closely checked for accuracy.

Assessment Notice: Issued after the department assesses your GST liability and finalizes the amount payable.

Recovery Notice: Sent if you don’t pay dues on time—this may include steps like attaching bank accounts or assets.

Notice for Personal Hearing: A call to appear in person and clarify issues or provide more details.

Always respond to GST notices on time with the right documents to avoid penalties or legal trouble.

Top Reasons Why You May Receive a GST Notice

The GST Department may issue notices for several reasons. Some of the most common are:

Differences between GSTR-1 and GSTR-3B filings.

Mismatch in Input Tax Credit (ITC) claimed in GSTR-3B vs. GSTR-2A/2B.

Not filing GSTR-1 or GSTR-3B for more than 6 months.

Mismatched details between GSTR-1 and the e-way bill portal.

Not reducing prices after a GST rate cut (considered profiteering).

Non-payment or short payment of GST, even if not intentional.

Wrong or fraudulent refund claims.

Incorrect use of Input Tax Credit (ITC).

Running a business without GST registration when it’s required.

Export details not matching between ICEGATE and GSTR-1.

Not sharing records or information when asked by the tax department.

Being selected for a GST audit.

Failing to file information returns on time.

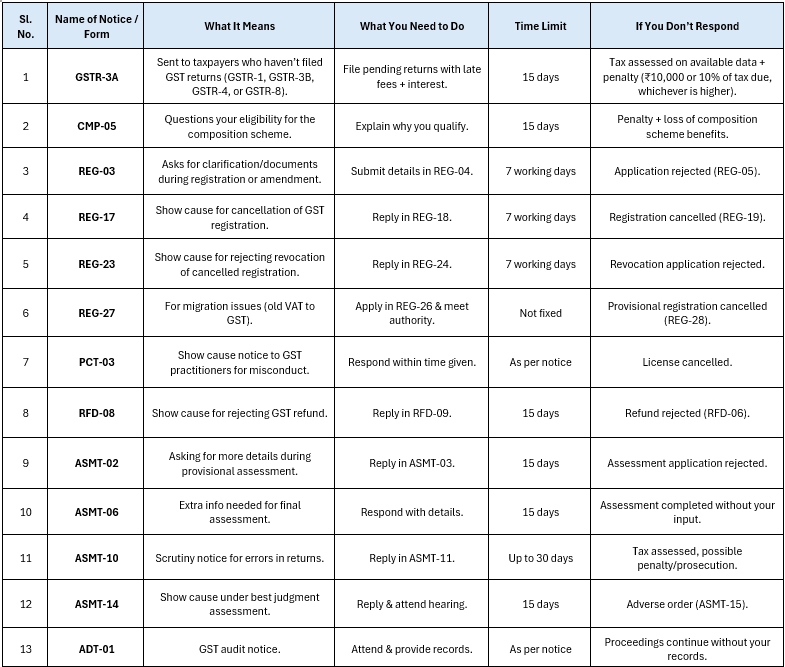

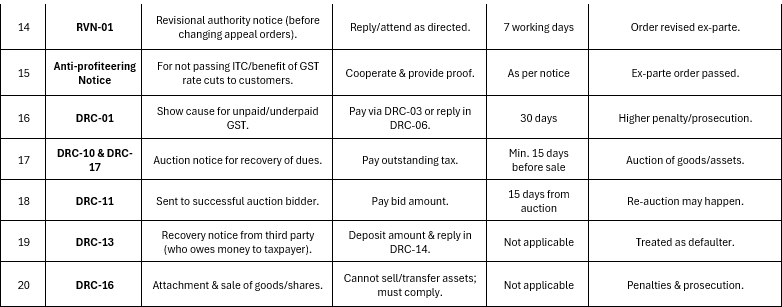

Common GST Notices and What to Do

How to Reply to GST Notices

Getting a GST notice can feel stressful, but responding the right way makes things easier. Here’s what you should do:

Read the notice carefully – Understand what the tax department is asking or pointing out.

Collect supporting documents – Gather bills, returns, records, or any proof related to the issue.

Log in to the GST portal – Use your credentials to prepare and file your response.

Use your digital signature – Authenticate your reply with your registered digital or e-signature.

Pay any dues (if applicable) – If the notice mentions pending tax, interest, or penalty, clear them before replying.

Submit your reply online – Upload your response along with the required documents on the GST portal.

Keep a copy for records – Save all submissions, payment receipts, and communications for future reference.

👉 Need help? The experts at Filingwise can prepare and file your GST notice reply quickly and correctly, so you stay compliant without hassle.

What Happens If You Don’t Respond to GST Notices

Ignoring a GST notice can create serious trouble. If you don’t reply within the given time:

You may face penalties, interest, or fines.

The tax department can make an assessment based on their own records, which might increase your liability.

In some cases, it could lead to cancellation of GST registration.

Persistent non-compliance can even result in legal action or prosecution.